Raising Capital

At ONEtoONE Corporate Finance, we have a strong track record in sourcing worldwide equity finance from venture capital or private equity firms, family office, and corporations. If you are looking to find investors for your business, we can help you structure and negotiate the terms of your financing. We can also provide the most appropriate solution to your capital needs.

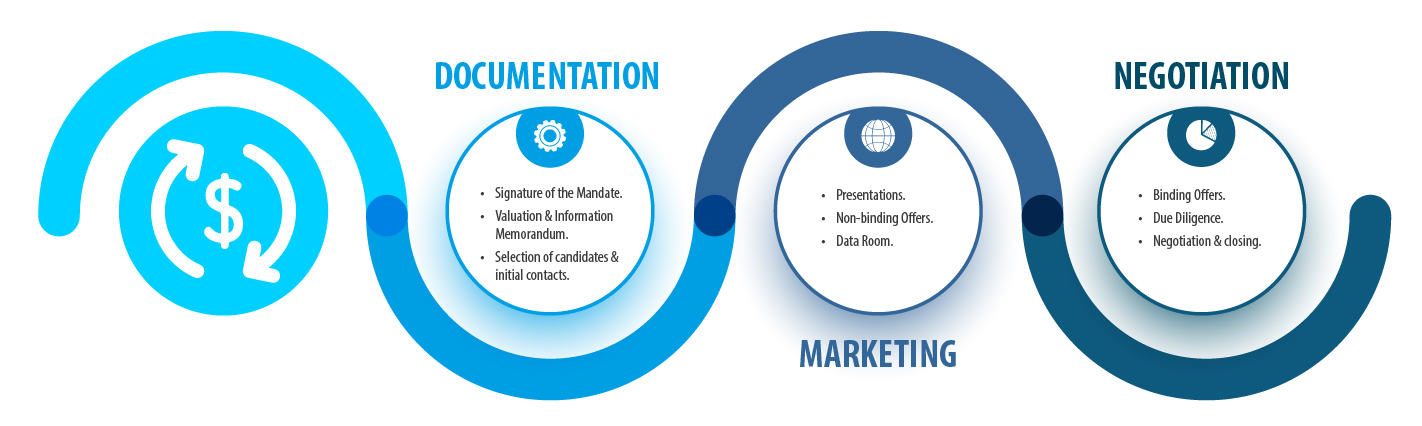

Fundraising process

Are you locating the best investor?

At ONEtoONE, we couple our unique research and mapping methodology with our extensive global team, to attract and select the best possible investors for your company.

We conduct worldwide searches

Our investor search team uses International databases to locate and contact the best potential investors throughout the world. Every company is different. In order to maximise the value of your company, we work to find investors with the highest synergies and greatest financial resources.