Selling your company with a clear, strong and proven methodology

The value of a company is totally different depending on who is buying it, why they are buying it and what they are buying it for, so if you want to maximise the sale price of your company, the quality and focus of the process is critical. ONEtoONE has a wealth of experience in advising on the sale and purchase of businesses and uses a robust methodology aimed at maximising the price.

The sale of your business only happens once in a lifetime and it is a complex process. From the moment our clients engage our services, we put in place a structured process aimed at achieving the best possible price for the sale of their company.

In order to achieve the best results, we have developed our own methodology capable of creating a unique sales strategy, according to the interests of the entrepreneur and the business situation.

A WORLDWIDE NETWORK

FINDING THE BEST BUYER, WHEREVER THEY ARE.

TAILORED TO YOU

A PROCESS DESIGNED SPECIFICALLY FOR YOUR BUSINESS.

EXPERIENCED ADVISORY TEAM

YEARS OF EXPERIENCE AND NUMEROUS SUCCESSFUL TRANSACTIONS.

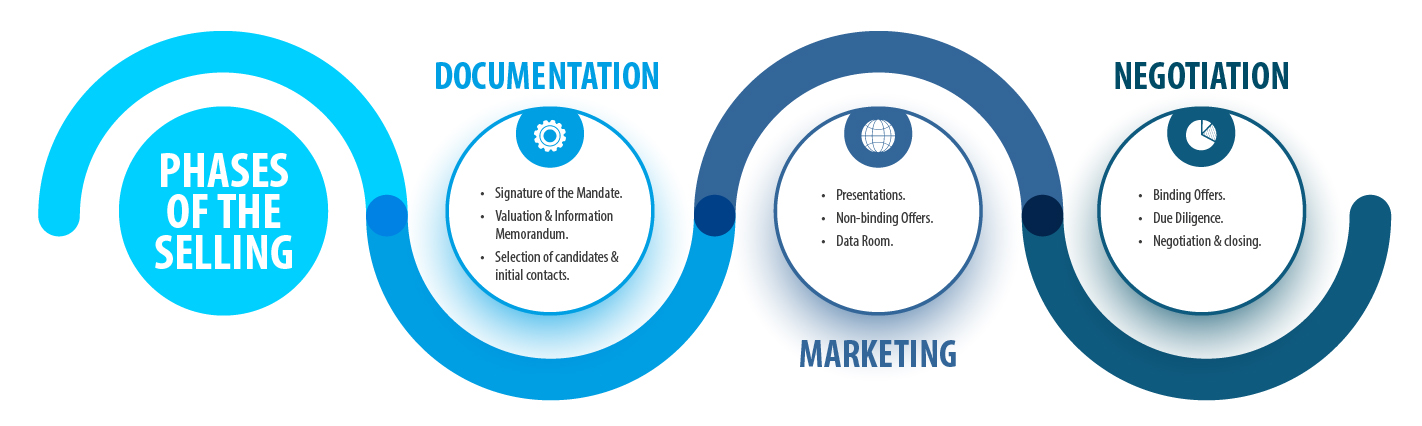

Phases in the sale of a business

Selling a company is a complex process that requires a team of advisors specialized in the company’s sector of activity. In summary, the sale is structured in 6 stages: documentation, search, marketing, offers, agreements and closing. Find out more about these steps and what they consist of.

DOCUMENTATION & SEARCH

- Signature of the mandate.

- Valuation and Information Memorandum.

- Selection of candidates and initial contacts from a world map of buyers.

- Synergy analysis.

- Explanation to investors.

MARKETING & OFFERS

- Presentations and signature of documents with confidentiality.

- Follow-up report.

- Virtual Data Room.

- Receipt of non-binding offers.

- Negotiation of offers.

- Reports on meetings and contacts.

NEGOTIATIONS AND CLOSING

- Binding offer.

- Coordination of due diligence.

- Sale and Purchase Agreement (SPA).

- Due diligence negotiation.

- Closing.

Most frequently asked questions about sell-side transactions

HOW IS A COMPANY SOLD?

In the sale of a company the timing, process, prices, the state of the market and negotiation are principal factors. Above all, you have to know how to find the buyer that can pay the most.

Once you have made the decision to sell, your advisor will guide you through the initial phases of documentation and company valuation, the search for the ideal buyer, the due diligence process and finally, the negotiation of the sale and purchase agreement (SPA).

WHY DO I NEED AN ADVISOR IN THE SALE OF MY COMPANY?

A well-designed business sale consumes a lot of resources and can be an extremely frustrating process. It is also a critical period in which the seller cannot take their eye off the performance of their business. Your business needs to appear at its best to those who are judging its value.

If you have not been through this process before, you can benefit from the detailed guidance and support that an advisor offers. An advisor ensures that you are fully prepared and aware of all the actions you will need to take during the sale of your company. In turn, you can feel confident that you will receive the maximum value for your firm. You will find out how to properly assess all of your sale options.

ONEtoONE can offer a comprehensive and proven methodology that explains how to get the best out of selling your life´s work.

DO I HAVE TO LOOK FOR A BUYER IN ONLY ONE COUNTRY?

When selling your company, it is important to avoid selling to the first buyer thata makes an offer, and secondly, know how to identify a good alternative.

ONEtoONE can help you answer to the three key questions to identify the best buyer:

- What are the different types of buyers?

- Is the company of interest?

- What are the research methods?

With ONEtoONE´s global network, you do not have to be confined to one country, we can help you answer these questions and find your ideal buyer wherever they may be located.

WHAT HAPPENS TO THE COMPANY´S ASSETS IN ITS SALE?

A company owns two types of assets:

- Productive assets: assets necessary for business activity, such as specific machinery in a factory. These assets are normally included in the sales agreement.

- Non-productive assets: assets that are not part of the company´s production process.

When assets belong to the company, it is normal to spin them off from the company. The seller can buy the asset as an individual or through a holding company. However, each asset has to be analysed to calculate the tax cost of the spin-off.

The buyer may also ask to lease a non-productive asset, even if not interested in buying it.

WHY IS DUE DILIGENCE IMPORTANT IN THE SALE OF MY COMPANY?

The due diligence process is a basic procedure in a business operation or purchase transaction and involves checking risks and compliance, conducting an audit to verify facts and information, determining the state of the company.

Due diligence is essential for the closing of the transaction, both from the buyer’s and the seller’s point of view. It is an important step in the process of selling your company. It allows the buyer to examine and audit the business in order to decide whether to make the purchase.

WHEN IS THE RIGHT TIME TO SELL A COMPANY?

Considering personal, business and economic factors is the key to knowing when its time to sell. It is key to know how to spot a window of opportunity.

Some aspects to consider may be:

- Market trends

- A desire for a lifestyle change

- Foreseen future familial conflict

- Need for new incentive

- Health problems

- Conflicts of interest between shareholders

- Second generation takeovers

- Need of capita raise

- Growth

WHAT SHOULD YOU AVOID WHEN SELLING YOUR COMPANY?

Forgetting to carry out a reliable valuation of your company, not having a professional strategy and only negotiating with a single buyer are common mistakes to avoid in the sale of your company.

Instead of falling victim to these errors, be prepared to take your company off the market and professionalise the selling process to ensure you do not miss the best deal for your life´s work. Keep in mind the interests of minority shareholders and don´t be afraid to confront the company´s intrinsic obstacles in order to overcome the unavoidable challenges you will face in the selling process.

HOW MUCH IS MY BUSINESS WORTH IN ITS SALE?

By definition, the price of a company is the amount for which two independent parties agree to when carrying out a sale and purchase transaction. This amount is fixed during the negotiation process.

For many business owners the company value is a combination of intrinsic value+market value+emotional value.

On the contrarty, the buyer looks for the company´s true value. This is based on the profitability and risk of a company.

To get the best price possible, you must know the value of your company, as well as the difference between price and value. To do so, obtaining a professional valuation is the key first step.

The right buyer will understand what your company is worth and pay the price it deserves.

Related articles

If you want to expand your knowledge on company sales, don´t hesitate to consult the wide variety of articles available on the ONEtoONE Blog. Ease all your doubts.

In the ONEtoONE blog you will find articles on the most interesting topics about the world of M&A, as well as the lastest news on all types of deals. Sell-side, buy-side, valuations, largest M&A transactions and trends in the sector.

Most recent sell-side transactions

See all ONEtoONE’s public closures on our successful transactions page.