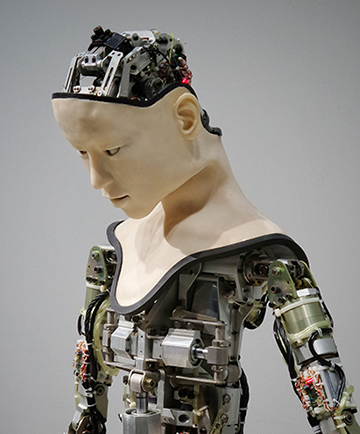

Will the next member of your M&A team be a robot? One of the world’s most potentially disruptive technologies is Artificial Intelligence (AI). Given AI developments in the areas of big data and pattern recognition, it is very likely that AI will increasingly be used in connection with a wide variety of M&A tasks. This will have a major impact on how mergers and acquisitions deals are done.

Overview of Artificial Intelligence (AI)

The term Artificial Intelligence (AI) is a broad concept that refers to technology that allows machines to carry out tasks that are ordinarily performed by humans. In order to perform these tasks, AI requires the development of software that allows machines to replicate different elements of the complicated human thinking process.

There are two general types of AI, Narrow AI and General AI.

There are two general types of AI, Narrow AI and General AI.

Narrow AI refers to the ability of a machine to apply a limited artificial cognitive function to carry out a narrowly defined task. An example of Narrow AI is the virtual assistant Siri, which is capable of speech recognition and searching for information on the Internet in response to queries. Other examples of Narrow AI are machines that play chess or Go, which select optimal game decisions from a wide set of mathematically calculated move possibilities.

General AI refers to the ability of machines to carry out more sophisticated reasoning processes and draw conclusions about courses of action which are different from possibilities that have been programmed into their database. In other words, General AI allows machines to not only perform pre-determined responses to a defined set of response triggers but rather to engage in higher-order thinking that involves creativity, innovation and improvisation.

To provide an example of the difference between Narrow AI and General AI, with Narrow AI, an autonomous car with a driving scenario database that contains examples of cars stopping at stop signs would stop the next time a stop sign was encountered. With General AI, an autonomous car would be able to reason that it should not stop at a stop sign if conditions made stopping particularly hazardous. Machines are still far away from exhibiting General AI.

AI and Mergers & Acquisitions

AI will very likely soon have a significant impact on M&A. To begin with, the preliminary application of AI will likely be to assist companies and financial analysts with gathering and processing information that can be used to make different types of M&A-related decisions. While humans can, of course, execute these tasks, AI-supported machines will be able to carry out these activities continuously, much faster and have far better recollections of search results.

Focusing on specific areas of the M&A process, AI can transform the activity as follows:

1. Market and Sector Data Extraction. To provide one type of example, machines could extract economic or sector data in real time which would allow firms to have a much more detailed and nuanced view of the business realities within a country or sector. This will be advantageous because companies often make investment decisions based on market perceptions or biases that do not reflect actual market realities which causes them to miss opportunities or assume unwanted risks.

Armed with this knowledge a company could develop stronger M&A strategies and more sensible transaction timetables. In addition to obtaining information regarding one country, machines could gather information about multiple markets and sectors and compare them to identify acquisition opportunities that likely offer the best ROI or risk-adjusted returns.

“ AI could gather information about multiple markets and sectors and compare them to identify acquisition opportunities that likely offer the best ROI.

2. Company Selection. Once a general M&A strategy has been developed, AI could be used to identify potential M&A targets and track information about them or information that affects their business models. For example, for an acquirer that was targeting the acquisition of a real estate company, AI could be used to gather several types of data which would allow the attractiveness of the acquisition opportunity to be analyzed, such as macroeconomic data, interest rates, property prices and company information. This would allow for a more sophisticated, multi-dimensional view of targets and how they react to surrounding business and economic conditions.

3. Due Diligence. The evaluation of M&A opportunities is often accompanied by extensive due diligence regarding the business environment in which a company operates in, the company and its competitors. AI will allow acquirers to develop increasingly sophisticated models of due diligence where the work of advisors such as bankers, lawyers and accountants is accompanied by various types of AI-assisted search queries. Machines will also likely be able to detect discrepancies between target narratives of either past of probable future event and past or likely future realities which can become the basis for further due diligence questions and analysis.

4. Business Valuation. Another way in which AI could be used to support the M&A activity is in the area of valuation. With the market method of valuation, different types of multiples, such as an EBITDA multiple, are extracted from the market and then applied to the financial performance of the target company to arrive at a company valuation.

In connection with the market valuation method, AI could be used, first of all, to extract in real time EBITDA and public share price data to create a live database of EBITDA multiples. In addition to this baseline EBITDA multiple information, AI could also be used to create individualized valuation adjustment formulas that were based on certain criteria, such as the size of the company or larger company sector trends to arrive at better valuation calculations.

A second valuation approach is DCF analysis, in which the future free cash flows of a company are calculated and then discounted by a discount factor which in theory reflects the risks that are related to those cash flows. AI could assist with this type of analysis by gathering information on discount factors and risks to a company’s cash flows.

| You may be interested in: How to value a company? The usefulness of the business valuation process. |

5. Add-On Transactions and Exit Strategies. Most M&A strategies involve the contemplation of helping targets to grow or planning for an investment exit. Because of its ability to monitor and calibrate company performance, competitor performance and larger market conditions, AI will be able to help companies better plan post-acquisition steps.

The application of General AI to M&A is much farther off, but if machines are able to learn higher forms of human reasoning they likely will be able to play a major role in developing M&A strategy, forming due diligence queries based on factual analysis and even in the psychological analysis of management teams.

Conclusion

Advances in AI will allow machines to access and analyze exponentially increasing data about economies, markets, companies and companies’ consumers. This ability will assist companies and financial analysts with gathering and processing information that can be used to make different types of M&A related decisions, making core business processes faster, more efficient and accurate. Some of the most impactful foreseen areas of improvement will be in market and sector data extraction, company selection, due diligence, business valuation, add-on transactions and exit strategies. As the depth and complexity of AI grow, so does the range of its application use in vital business processes.

The photo for this article was taken by Franck V on Unsplash.