Generally, we find the articles about private equity funds in which it is discussed what these companies are looking for or what type of company they invest in. In this article we wanted to change the direction and perform the analysis from the entrepreneur’s point of view, as our main goal is to understand how a private equity firm can contribute to your company.

Furthermore, we usually have the perception that private equity funds or their societies only invest in big companies. This is due to the amount of news about it, however, this conception is far from reality, since most venture capital operations are carried out in family businesses. These are operations that go unnoticed in the press, but that play a very important role to boost our business network.

Table of contents |

What is private equity and who forms it

Private equity entities are investment vehicles. Its mission is to invest in companies, create value over a period of approximately four or five years and sell its stake with the greatest possible surplus value. Private equity funds are the type of investment that generally invest in non-listed companies that find themselves consolidated, therefore, they have a history, growth and cash flows. Private equity invests money in companies in the medium term, usually with entry into the capital of private companies to help them grow and succeed. The counterpart for the risk assumed usually occurs, in case of success, in the form of capital gains.

In growing companies, private equity investors specialize in development capital and family offices, which are offices created for the integral management of a family’s assets. When the company enters a stage of maturity in which the growth stops being so accused and the profits become stable, the potential buyers or capital funds that come into play are the so-called buy-outs, which are capital funds, specialized risk in purchase with debt.

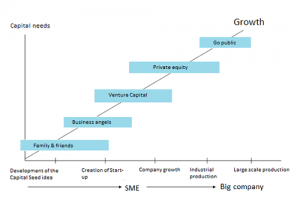

The following table reflects the types of investment according to the stage of the company:

“ If your company is growing and looking to expand, if you want to sell it or pass it on to managers, private equity can help you.

If you already know what private equity is, you might be asking who actually forms it. Or even, who invests in private equity? Within the world of investors in private equity we can distinguish different classes, among which we could highlight the following:

- Individuals: normally wealthy families.

- Big organisations: in private equity they mostly look for the possibility to have access to new technology to make the product line better or to carry out an adequate diversification policy.

- Financial institutions: along with the pursuit of profitability, they also seek to have a quarry of companies linked to the bank or cashier, but without facing the risks of a direct and permanent participation.

- Institutional investments: insurance companies and pension funds, taking advantage of long-term investment horizons.

- Organizations and institutions of the public sector: The objective is to promote a financial activity with undoubted positive effects on the business fabric of a country, with the consequent impact on employment, investment, exports and collections for various taxes.

- Foreign investors: some seek to develop an international network of private equity entities by providing their name and experience. Others look for investment opportunities that the country can offer.

In the area of financial investors, there is a lot of public information about private equity entities and their investment preferences. The family offices, however, will find it more difficult to locate and contact.

Private equity contributions

If your company is growing and looking to expand, if you want to sell it or pass it on to managers, private equity can help you. Apart from being a source of additional or alternative financing, private equity offers a series of “collateral” contributions that in many cases become the true elements of value for the entrepreneur. Below, we indicated a series of private equity benefits that can support your compan

- Inject capital into the company to face the future with greater warranties.

- Support the definition of the company’s medium and long-term strategy.

- Advise managers on a wide range of business areas.

- Can introduce you to many contacts from various sectors and businesses.

- Can provide you with cross-business from other investments.

- Optimize your company’s financial structure, as they are able to offer additional support to projects financed by subordinated debt, etc.

- Help your company’s professional image improve in the eyes of other financial investors, suppliers, clients, employees, etc.

- Manage relationships between partners in a professional manner.

- Demand high levels of professionalization in management.

- Require a level of professional and sufficient reporting to adequately monitor the activity.

- Allow professionalizing the dialogue of the Boards of Directors and focus the decisions towards the creation of value for the shareholder.

- Support the selection and hiring processes of the executive managers.

- Bring some experience in business internationalization projects.

- Allow preparing the company for a sale at approximately 4-7 years with greater guarantees for maximizing the sale price at the exit.

- Design attractive compensation packages for managers, motivating and retaining the main managers to remain aligned with the project

- Leave the entrepreneur or the manager autonomy in the daily management of the business.

- They can contribute simultaneously in mixed operations resources for the shareholder (cash out) and resources for the company (cash in).

- They can substitute any shareholders who are not aligned with the business project.

- Allow professionalizing the management of the company with an eye on the employer’s retirement when he does not have a clear succession project.

How to get the financing

Obtaining the financing of private equity funds for your company is difficult, but at the same time it can represent a turnaround during the life of your company. Private equity entities receive a large number of projects, but select one in a hundred. Therefore, when considering the search for private equity for your company, to provide resources and with whom you can stay a few years growing your company, it is essential to prepare the proper documentation so that your company exceeds the filters of private equity entities.

“ Private equity funds will be your partners and you should trust them when they entered the company, but until then, they are your adversaries in the negotiation and you must be careful to protect your own interests.

This documentation must demonstrate the following elements:

- An ambitious business plan. This plan must be realistic as well as ambitious to obtain financing for private equity. It seeks significant returns and therefore must demonstrate that its market has the capacity to grow, especially through acquisitions. In fact, private equity wishes to carry out consolidation processes in the sector and, therefore, growth via acquisitions is a fundamental requirement for them.

- Design the exit plan. Private equity, before deciding to enter a company, wants to understand and plan how it will leave that company. Entrepreneurs can also stay in another round of financing with a private equity fund of the next level or, alternatively, they can go out with private equity obtaining a much higher price through the sale to a strategic group.

Keys to negotiating with private equity firms

Another crucial aspect to obtain private equity funds is a good negotiation with investors. If you negotiate with private equity, they will take your free cash flow forecasts and apply a 20% or 25% discount rate. The price that comes out (and if they have found reasonable forecasts), is what they will be willing to pay.

Another way they can lower the discount rate with is debt: the less money they can put and the more they lend them the banks, the greater the profitability that will come out for the money they put in and therefore, the more they can pay for the company. That is why, when negotiating with private equity, it is so important to help your indebtedness with banks. If the banks see that the numbers are solid, clear and well explained and documented, they will be more confident in the future flows presented to them and as a result they will lend more money for investment in the company. The more you help in this, the higher the price the company can sell.

Although there is no magic recipe for negotiating with investors, there are a number of factors that certainly contribute to making the negotiation a success. If you are considering entering a private equity firm and wish to prepare a good negotiation plan, the ONEtoONE advisory team is at your disposal.