DeFi Service Projects and Use Cases

Most DeFi projects or protocols can be categorized into these main project types:

Decentralized Exchanges

Known as Dexes, are cryptocurrency exchanges that allow you to trade currencies without an intermediary. One example and one of the leading Dexes is Uniswap (an automated market maker protocol that runs on Etherum).

Lending Platforms

Decentralized finance allows anyone to borrow or lend cryptocurrencies. Users can earn interest yield when they loan their assets. They can also borrow cryptocurrencies by using their own funds as collateral. CoinLoan, Lending Block and AAVE are leading cryptocurrency lending protocols.

Savings

Like with a traditional savings account, you deposit the money you want to save in a bank and cannot withdraw it for a set amount of time, although at a very low interest. Crypto-saving works similarly, but the benefits overshadow those of a savings account in a traditional bank.

- There are dApps like compound that allow participants to create a network of people to allow them to pool their money to earn interests. borrowers can take a loan from these pools. These borrowers are required to pay the collateral as security against the loan and are scheduled to pay interest back into the pool.

- There are far fewer limitations on withdrawals

- Because of the blockchain platforms provide more rigorous security for their assets.

Insurance

Cryptocurrencies are tied into smart contracts, which can be vulnerable to hacks and other security breaches. This is the reason why the insurance sector has now set foot into the DeFi space.

Insurance is meant to protect a customer from uncertain losses and provide a plan of risk management in case of a financial loss. Cryptocurrency insurance is similar to insurance for any other asset and protects against various risks attached to cryptocurrencies.

- Technical risks: risks involved in the coding of smart contracts and development bugs.

- Liquidity risks

- Admin-key risks: Admin-key could be considered as the master key to all accounts on a particular platform; if it is stolen, everyone on the platform is at risk of being robbed.

Derivatives

In traditional finance, derivatives are defined as a commodity that derives its value from an underlying entity. These underlying entities can either be interest rates, stocks, commodities, indexes, or currencies (in the case of DeFi, cryptocurrencies). Derivatives are essentially contracts that are designed and signed by two or more parties, mainly for risk management purposes, agreeing to the purchase or sale of an asset at a decided price in the future.

Another reason that derivatives are used is to speculate the direction in which the prices of an underlying asset will move.

In decentralized derivatives exchange, the need for a broker is eliminated. Instead, these contracts and leverages are coded into smart contracts. Moreover, the transaction is completed on-chain when the decided terms of the contract are fulfilled.

DeFi derivatives include forwards, futures, swaps, and options.

BitMEX is one of the first platforms to introduce decentralized derivatives in 2014, and since Dapps like Binance and Huobi have followed suit.

Asset Management

DEFI protocols are the future of finance but unfortunately, unless you are deeply immersed in the space, many potential investors don’t have an idea of what protocols are worth following let alone what are worth investing in.

The process of buying into a DeFi asset requires climbing a steep learning curve. Having a wallet and having to fund a separate crypto account is foreign and intimidating to the average investor.

In the past year alone, we’ve seen several products offering different ways to either track, manage or hedge exposure through a suite of various DeFi projects in the lending, DEX and derivatives sectors. The common theme is that of accessibility, ultimately making it easier (and safer) for DeFi users to keep track of their ecosystem interactions in a suite of intuitive dashboards and interfaces.

Some key characteristics:

- Non-custodial – Ownership of the underlying assets is never revoked and tends to live in the wallet being used.

- Composable – Many of the top Asset Management projects connect to a wide number of DeFi projects, creating an end-to-end DeFi experience.

- Automated – The growing number of Asset Management tools are automated, meaning rebalances, collateralization, and liquidations can occur seamlessly without user interaction

- Globally Accessible – Asset management tools are accessible to anyone regardless of their location or tax bracket.

- Pseudo-anonymous – Asset Management products often connect through a wallet address, meaning that identity is optional to those who wish to share it.

Real assets:

Its is now starting to fly but over the past 2 years some of the DeFi assets also include private companies, real estate as well as hedge fund shares. Such types of assets generally feature additional growth and income mechanisms, subject to algorithmic allocations alongside the benefits of transparency in Ethereum. What would happen is that real asset projects would raise funds through an ICO. Like in an IPO scenario there would be a secondary market for these tokens.

Assets tokenization:

Help to enable organizations to dematerialize assets in the form of tokens that are legally compliant via a decentralized blockchain that are digitally accessible for investors.

Payment solutions:

Eliminating central authorities to offer a faster, efficient and more transparent payment systems to the unbanked population.

Bottom Line and DeFi Metrics

Understanding Blockchain, Crytpo and DeFi concepts allow us to understand that in the end, DeFi is about providing financial services from a decentralized platform (meaning no intermediation). To enter the DeFi market, whatever the project one would one to buy in, one should acquire a project token. That is, the currency in which the project transacts in (cryptocurrency). For example, Ether for Ethereum. A good way to analyse tokenized projects would be to know:

- Who is behind the project? One way to do so is to find out if there are any known VCs behind the project

- Know if it’s a reliable product trusted by many developers. The more applications that are built on that blockchain, the better.

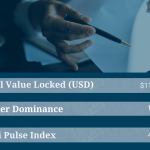

- There are KPIs that are more market aligned like:

a- Total Value Locked (TVL): The most popular metric for DeFi is the TVL metric. TVL represents the total amount of assets locked in the various DeFi applications smart contracts. This metric is used to assess how much crypto is committed to a smart contract of a project. The total value locked in a protocol can be measured using crypto or USD. In a particular marketplace, TVL is the sum of total liquidity in the liquidity pool. TVL is often used in combination with the market cap, which is calculated by multiplying the value of tokens by their price in USD. As a rule of thumb, the lower the TVL, the more undervalued a DeFi project is. However, there’s more to consider besides the TVL when making a decision.

b. Token Supply on Exchanges: While DeFi aims to decentralize financial operations, it’s still essential for you to check the supply of tokens on centralized exchanges. If an abundance of tokens is held at the exchange, it points towards a significant sell-off in many cases. As a result of such a sell-off, the token tends to destabilize. Thus, it’s imperative to look for these signs while performing due diligence on your cryptocurrency. However, things don’t always turn out this way, and you also need to weigh token supply and other DeFi indicators when making a decision.

c. Token Balance Trends/Movement: The token supply doesn’t always indicate a large number of withdrawals from wallets. You also have to look at the balance movements of the token on the exchange. Keep in mind that it’s characteristic of crypto trading to move tokens from personal wallets to exchange accounts, and vice versa. Only a highly uncharacteristic or significant movement should tip you off when making decisions about DeFi tokens.

d. Inflation Rate: Most DeFi protocols have rules in place to ensure the token supply doesn’t cause inflation, leading to the devaluation of the DeFi tokens. However, this doesn’t apply to every token. While some projects don’t clearly explain the mechanism of maintaining a limited token supply, others don’t even have any coherent information on the subject. Therefore, when you’re selecting a protocol, look at whether a token is susceptible to inflation. If the answer is yes, it’s best to stay away.

e. The Growth of Unique Addresses: If a large number of unique addresses are holding a particular token, that could mean it’s growing in popularity and is being adopted massively. As an investor, you can use this as a metric to determine the relevance of an asset. However, it’s also important to note that a single user can create many addresses, keeping their funds in separate accounts. That could give the false impression of a token being widely used. So, be wary when using this metric. It’s best to use it along with other key performance indicators, as discussed in this article.

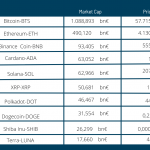

Key Players According to DeFi Pulse[2]

DeFi KPIs and Indexes

[2] https://defipulse.com/

Top Projects by TVL

Top Lending Projects by TVL

Top Derivatives Projects by TVL

Top Cryptocurrencies as of November 9th 2021 18:00[3]

[3] https://www.blockchaincenter.net/

This article was written by José Ramírez Terc, specialist in 21st century business models.

About ONEtoONE

Our company, ONEtoONE Corporate Finance, is specialized in international middle-market M&A advisory. We are continuously focusing on improving the techniques to achieve the best possible price for our clients, and we also advise on acquisitions, strategic planning and valuation. We are pleased to give our opinion about company valuation or other aspects of a possible corporate operation. If you need an advisor while buying or selling a company,

contact us.