Have you ever wondered what the difference is between a company’s price and value? Most people use the value and price of the term interchangeably, but in the sale of a company, the difference is of paramount importance.

It is not uncommon for you to have used the word value when you meant price and vice versa. Value and price are very different economic concepts that must be distinguished, especially in corporate transactions.

In these processes, the final price is usually only known on the day of the sale signing; until then, the amount depends on the negotiation.

Value and price are closely related. Here we tell you how these two concepts influence each other and how you can distinguish between them.

Table of contents |

The value of a company

From time to time, we find, in the news about mergers and acquisitions, that a particular company “has been sold for 10 million euros, which has meant a valuation of 6 times its EBITDA”.

The question then arises: “The price is 10 million. So, the value of the company was 10 million?”. The financial answer to the question of how much a company is worth must be based on these two concepts.

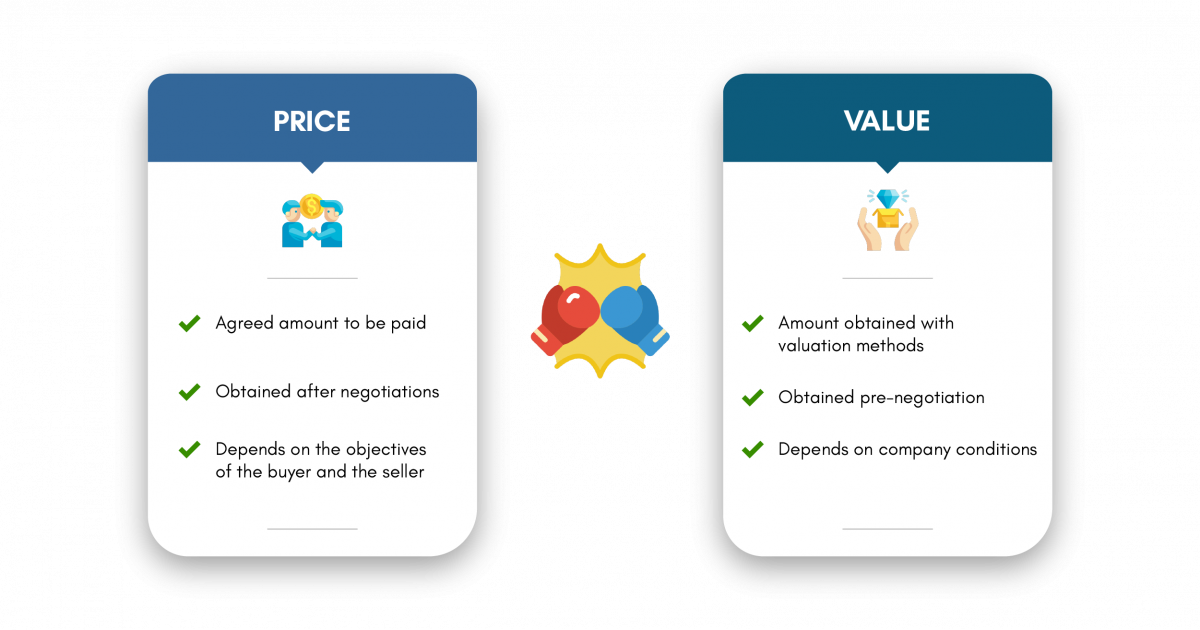

Technically, the price of a company is the amount for which two independent parties agree to carry out a sale and purchase transaction, which is fixed during the negotiation process.

Value is a more subtle concept. In a sense, it is the amount that an investor should pay for a company, and this figure is related to the liquidity that the company would be able to generate in the future.

From a certain point of view, value can be seen as a wholly subjective and emotional concept. In reality, entrepreneurs often attribute economic and material value to their companies based on criteria of emotional attachment, loyalty and faith.

Nothing could be further from the truth: value is a quantifiable concept. The method used by business analysts and traders to quantify the value of a company into a number is called valuation.

Valuation is the first and essential step in agreeing on a sales price.

There are various valuation methods. Depending on the method used, the valuation may yield different results on the value of the company. An experienced advisor can select the correct one(s) and can set a value range that minimises the possible margin of error. On the other hand, in the context of a business sale and purchase negotiation, value can be understood as the value that each party assigns to the company, according to its interests. It is therefore a monetary measure of the degree of utility that the company will bring to the buyer of the company.

The price

For all these reasons, and based on valuation, we approach the price. The price is the amount to be paid and will be subject to negotiation due to differences in the perception of the value of the parties involved and their respective interests.

The price is the tangible value achieved at a given point in time through the sale of a company. It depends, in addition to the company’s valuation per se, on the supply and demand at that time.

The price is the result of the competing interests and aspirations of the buyer and seller.

In addition, it will be influenced by entirely subjective factors, such as the negotiating skills of the buyer and seller. The more skilful the one with the better arguments will be able to bring the amount closer to their interests.

In short, the price of a business is the amount agreed, upon after a negotiation process, by two parties to a sale and purchase transaction. The price is determined by:

- The result of the valuation methods performed by the seller and the buyer.

- The market supply and demand at the time of the negotiation.

- The agreement between the interests and aspirations of the buyer and seller after the negotiation.

The role of valuation in the path to price

As we have seen, the seller and buyer will assign a value and a price to the company according to their respective interests, depending on the valuation methods.

The figures derived from the valuation methods are directly related to the elements of the company, such as its liquidity and ability to generate future income, among others.

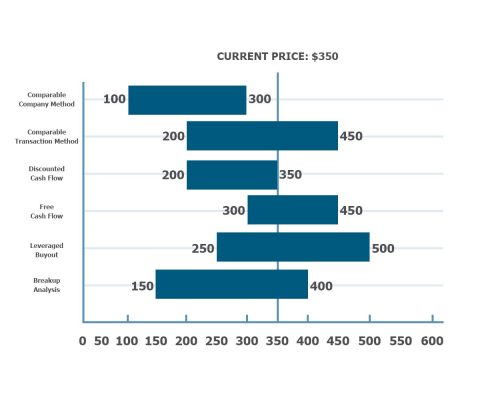

This difference in results is because it is difficult to determine the value of a company, as valuation is not an exact science. The result will vary depending on the method used, such as liquids, which take the form of the container that holds them.

There are different valuation methods, and each advisor will choose the one they consider most appropriate to the reality of the company being valued:

Comparable Company Method (CCA)

This is when you evaluate your company’s value by utilising the variables that companies similar to yours have. Use this to determine their value, like sector, size, growth rate, margins, and how profitable they are.

Comparable Transaction Method (CTA)

This method involves analysing and estimating your company’s value by comparing prices paid in transactions for similar companies.

Discounted Cash Flow (DCF)

Using this appraisal method, you will determine the company’s value based on its future cash flows. You apply a discount rate to each year’s projection to calculate the result according to the present value of money.

Free Cash Flow (FCF)

Contrary to DCF, a company’s value is based on the net profit. Meaning the amount, the company generates after accounting for the costs of operations and maintenance of capital assets.

Leveraged buyout (LBO)

This projects its value by analysing the contributions made by the alternative sources to the net Internal Rate of Return.

Breakup Analysis

With this, you look at your lines of business, which means that its components determine your company’s value.

If you are interested in learning about all these methods in detail, you may be interested in reading our article on business valuation methods:

When selling a company, a professional valuation is highly recommended. It should be carried out with two objectives in mind:

- Understand the company’s value range.

- Provide economic and business arguments to underpin the negotiation.

Because of all the factors mentioned above, it should be borne in mind that, strictly speaking, a valuation will result, not in a value, but in what we call a “value range”.

It is possible to estimate how much a company is worth. Still, because of all the elements involved and the subjective values we have discussed, it is unrealistic to think that you can know its value exactly.

True valuation professionals will always talk about a range of values. From there, they work to translate it into an advantageous price during negotiation.

Negotiation is the sale phase, where the price of the deal and its outcome are at stake. Knowing how to avoid the most common mistakes in this phase guarantees the transaction’s success. If you are interested in knowing what mistakes to avoid and how to avoid them, do not hesitate to download the e-book we have created to help you: Errors in the sale of a company. Part 2: The negotiation.

Maximising the value of the company to obtain the best price

As we have said, the valuation result will give a “value range”. At this point, the question is: “How can this value range be translated into an advantageous price when buying and selling a company?”.

First, we will have to find the point in this range that can provide us with an accurate idea that brings us closer to the price we want to achieve.

You may be interested in: Why is a company valuation important?

Each advisor will prefer and recommend a valuation method, but there are several methods to get a clear answer. There are different strategies. The football field valuation strategy can be used. This method compares the various results provided by other valuation methods and averages the value of the company through the use of different types of valuation.

Negotiation will be the key to transforming the best valuation into the best possible price.

But to get to this point, the company must be adequately prepared, free of conflicts and all areas of the company ready to put on its best face, provide the best valuation result and translate this into the most advantageous price.

Preparation will be the key to your success. At ONEtoONE, we have prepared a checklist to help you get all the aspects under control that will impact your company’s value and help you get the best price.

If you are interested in considering the sale of your company and need professional advice, please contact us or fill in the form below: