You use services and products from Venture-Capital backed companies every day, yet you are probably unaware of this. Uber, Wish and Airbnb are just a few examples. It can be quite a tricky concept to grasp at times. However, even though the industry is in constant change, the fundamentals of venture capital remain the same. But what actually is Venture Capital?

If you are interested in modern business models such as uber read our article on 21st Century Business Models

In this article we will explore the main principles and provide you with the answers to all your questions.

How can you describe Venture Capital?

Well, it is a type of financing in which money is put into a firm, usually a start-up or small corporation, in exchange for a share of the company’s ownership. It’s also a significant subset of the private markets, which are a considerably bigger and a more complicated aspect of the financial landscape.

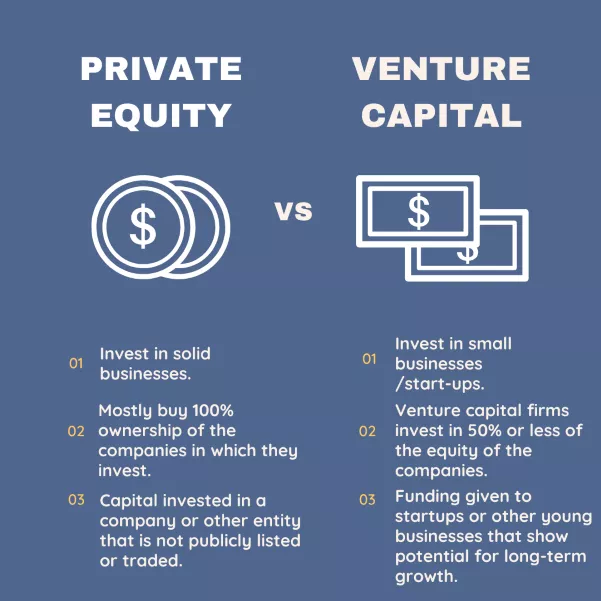

What is the difference between Private Equity and Venture Capital?

Venture Capital is actually a type of Private Equity in technical terms. The fundamental distinction is that, private equity investors favour solid businesses, whereas venture capitalists typically invest in start-ups. Small businesses with tremendous growth potential are typically given Venture Capital.

How do these type of firms make money?

Management and performance fees are how these firms make money. These can differ from fund to fund, but the 2-and-20 rule is usually followed. Management fees are calculated as a proportion of assets under management, which is usually around 2%. These charges are incurred on a regular basis to cover everyday expenses and overhead. Fees for performance are the amount calculated as a percentage of investment profits, usually about 20%. These fees are paid to employees as a way of rewarding their achievement and incentivizing higher returns.

To sum up although many of us don’t understand or realise that we use these type of companies’ services etc, it is importand to comprehend the main principles given it´s popularity in the finance world.