We say some companies have 21st Century Business Models for two reasons. Firstly, although tech companies have been around for decades, in this century industries are being disrupted not by technology itself but by companies with certain business models and specific characteristics. Secondly, these are business models born with the internet boom at the beginning of this century.

Let’s face it, there is a noticeable knowledge gap between traditional financing and investment firms, corporate finance, corporate development, and companies with innovative business models. It’s like in movies when superheroes could do amazing things together but they don’t understand how they can be of value to each other. That would, arguably, explain why this knowledge gap exists. The reality is that these pillars that fuel growth need to understand each other more than ever.

Our digital, tech, and new business model experts at ONEtoONE Corporate Finance decided that it was time to bridge this understanding. This 10-part series intends to so. Our goal is that:

- Investors, who finance growth or acquire companies, know what to look for and understand the value of certain companies with 21st Century characteristics.

- Corporate development managers and strategic buyers know what they should be looking for when sourcing potential acquisitions.

- XXI century CEO and Directors know what they would need to communicate to investors.

- Corporate finance professionals know how to add value to investors, acquirors and their sell-side/private placement clients.

In the series “Understanding 21st Century Business Models” we look to explain these models, what drives them, how they came to be, how they are innovation catalysts, general metrics that they use, and how to value the companies using them.

The series is divided as follows:

- General metrics used in 21st Century Business Models. Understanding 21st Century Business Models: Explaining 3 main business models in detail, plus 4 bonus business model summaries.

- E-Commerce.

- Marketplace.

- Bonus Model 1: OmniChannel.

- Cloud Market Group: X as a Service.

- Mobile Apps.

- Bonus Model 2: User-Generated Content.

- Bonus Model 3: Cloud Restaurants (Dark Kitchens).

- Bonus Model 4: Decentralized Finance (DeFi).

- Valuing XXI Century Business Models.

What are 21st Century Business Models and what drives them?

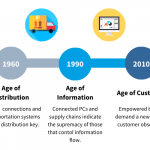

We are in the age of the customer-centric approach. By customers, we mean anyone or anything that would use a product or a service, meaning users, clients, businesses, governments, and citizens. In the 21st Century, business value creation is being driven by a customer-centric blend of physical and digital business models.

Source: Forrester Research. Design: ONEtoONE

Due to technological capacities, an extreme shift in demographics, ever-growing interconnectivity of humans, and a demand for faster human development, these models are characterized by their ability to scale at a faster rate and offer a bigger geographical reach than before, with higher profit margins and use of technological advancements allowing them to reach target markets faster.

The core of a 21st Century Business Models is the value proposition that solves a customer problem or satisfies a customer need.

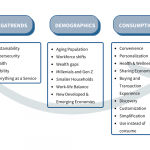

What is driving these customer needs?

How they came to be?

21st Century Business Models are not digital or technological companies themselves. Instead, they use technology to create new value in business models, customer experiences and the internal capabilities that support its core operations. In many cases they become digital companies, but before they get there they must go through innovation frameworks. 21st Century Business Models are designed as innovative responses to specific customer needs.

These business model innovations, whether digital or not, disrupt industries, creating new verticals within them that adapt new business models. Some of these verticals we call “Industry”-Tech. The best 21st century companies are digital companies that identify gaps in existing industries and business models that can be improved upon and/or exploited to better serve customers.

Our focus with this document is to illustrate some of the business models that allow for industries to be disrupted today. Hence, most of the business models to be discussed are digital. However we just wanted to clarify that they do not necessarily need to be digital models.

Some examples of 21st century verticals are:

- Mobile

- Mobile commerce

- Micromobility

- PropTech

- MortgageTech

- RestaurantTech

- Mobility

- Micro Mobility

- SaaS

- Virtual / Augmented Reality

- 3D Printing

- AdTech

- AgTech

- AudioTech

- Machine Learning / AI

- Big Data / Analytics

- PaymentTech

- Medicinal Cannabis

- ClimateTech

- CloudTech & DevOps

- Crypto Currency/Blockchain

- Cyber Security

- E-Commerce

- EdTech

- Digital Health

- Content Creation

- E-Sports

- Gaming

Who paved the way?

5 ways digital businesses innovate:

1. Asset-less platforms

Uber is the world’s largest “taxi company” and doesn’t own a fleet of vehicles. Airbnb has the most “rooms” but doesn’t own a group of hotels. Facebook is arguably one of the largest content companies in the world, all without producing content. What about Youtube? Companies don’t have to own the hard assets to provide the service. Users just want the service. Get the point?

2. Data

More data has been created in the past few years than in the entire previous history of the human race. Websites, smartphones, and sensors’ data are produced and collected around the clock. Determine what unique data you have, what you can obtain, and then how to use it to add customer value in ways that lock out the competition and create new revenue streams.

3. Change the economics

“Make money” by simplifying the pricing concept:

- Selling products as individual units.

- Products bundled together or with services.

- Charge by the time of use.

- Full or partial access.

- Subscriptions for a specific period of time.

- Memberships (single or group membership with or without tiers of value).

- Licenses (for a given time, or with escalating sets of features).

- Platforms (membership fees with or without transaction-based revenue sharing).

Modify the revenue stream:

- The user pays in a different way.

- Fixed fees vs commissions.

- Pay per use.

- Freemium.

- Make a third party pay (hidden revenue).

- The user gets free service/product and other pays.

- Ads (Ex; Google or bus stops).

- Discounts difference or fees on another’s product or services.

- Get paid from the savings or earnings achieved by your clients.

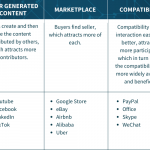

Create network effects

Metcalfe’s law states that the value of a network is proportional to the square of the number of connected users of the system. So, the more users, the more users get attracted to the network, and the more value is added to the network itself. The bigger the network and its interactions, the bigger the company value. There are many types of networks, each with virtually endless business model opportunities:

5. Combine innovative markets with business structure strategies

Explore the fundamental assumptions of current players in your market segment and then find business models from outside your space that disrupts the status quo.

Modify or eliminate steps in the value chain.

Associate with competitors, suppliers, or complementary businesses.

- Think on: Who is your target market? Who else targets them? How can you target them together?

Reduce the customers’ experience hassle and complications using a product or service.

Break an industry belief.

- Know the success factors that have withstood time. Can they be changed? Do restaurants and bars need a physical place to serve customers? Should hotels have a reception? Do bank loans need guarantees?

This article was written by José Ramírez Terc, specialist in 21st century business models.

About ONEtoONE

Our company, ONEtoONE Corporate Finance, is specialized in international middle-market M&A advisory. We are continuously focusing on improving the techniques to achieve the best possible price for our clients, and we also advise on acquisitions, strategic planning and valuation. We are pleased to give our opinion about company valuation or other aspects of a possible corporate operation. If you need an advisor while buying or selling a company,

contact us.