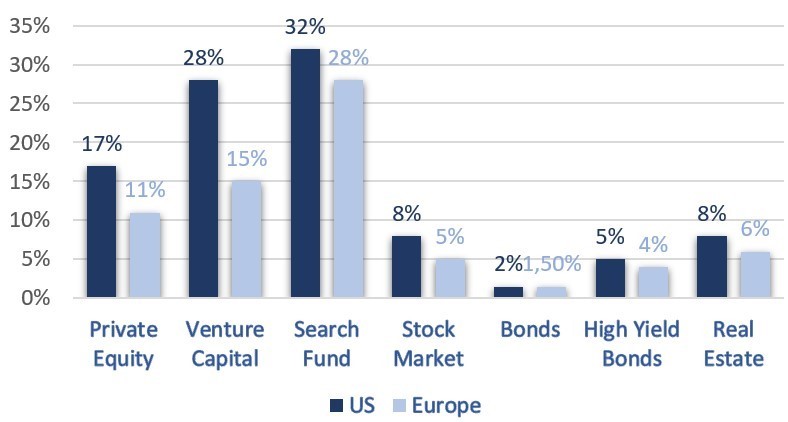

For the last few years, we have been witnessing the rise in popularity of Search Funds in Europe (and especially in Spain) thanks to a dynamic virtuous circle of an ecosystem with more and more Searchers, target companies, investors, and funders. Some readers have asked me how do you get it? In this article, I explain the four keys to such impressive returns for the investor.

No other asset generates such a high return with moderate risk.

It is due to the participation of four players, which have been fundamental to obtain average annual returns of 30%.

Let’s talk about the four pillars:

1. THE SEARCHER

A young person over 30 years old, with an excellent education (usually a prestigious MBA), with professional experience in very demanding firms such as big strategy consulting firms or investment banks, highly motivated to become an entrepreneur.

He no longer wants to work as an employee. He is at the peak of his professional life, at the height of his energy, and when you see him, you know that he will be successful in whatever he undertakes.

2. THE INVESTOR

Between 10 and 15 investors/advisors very experienced in business management accompany the Searcher in the company’s management.

The Searcher has with these investors a luxury Board of Directors formed by experts in venture capital, investment banking or former presidents of large companies, ordinarily inaccessible to SMEs of this size.

3. THE FINANCIERS

Today, a financial community of banks is willing to finance up to 50% of the acquisition.

These financial institutions need good projects to finance. They have become familiar with the model and its good results over the last few years. Moreover, they have overcome their initial reluctance to finance small SMEs, supported by the criteria of expert investors who invest their own equity in these companies.

The entrepreneur himself usually also finances the deal by accepting deferred payments and sometimes reinvesting part of the money he receives in the company.

4. THE TARGET COMPANY

Search Funds focus their efforts on identifying healthy companies, with understandable business models, with a defensible market position, without a high concentration of clients and with growth.

Target companies typically have more than five million euros in turnover and an EBITDA of more than one million euros. They have healthy EBITDA margins, typically above 15%, low CAPEX investment requirements, low working capital requirements and strong cash flow generation.

Find out more about Search Funds here

Historically, the average company acquired by the Search Companies has had sales of $8 million, Ebitda of $2.4 million, and acquired at an average price of 5.6 times EBITDA.

The Searcher (1) buy at an attractive multiple, thanks to the scarcity of competitors in the purchase, (2) increase sales thanks to the Searcher’s commercial energy and international capacity, (3) improve margins, given that these types of companies are usually not optimized, (4) make add-ons that change the size of the company, (5) make a professional sale process of a company that has increased its EBITDA to the level where they already buy at high multiples (6) thereby benefiting from the arbitrage of multiples.

We are in a virtuous ecosystem with more and more searchers, target companies, investors and financiers.

There are more and more young MBAs, who, instead of being part of the machinery of big business, prefer to follow the path of the Searcher and become entrepreneurs, masters of their destiny and, probably, millionaires.

Find this article on LinkedIn here