As we have said at the beginning of this series, 21st Century businesses require a new way of valuing them. Also, since their DNA is to grow exponentially, making profits might not be in their current radar. So, to value these companies, we need to understand and take the metrics that best drives value for them. These drivers will eventually directly affect cash flow generation when these companies mature.

Performing a valution:

Our intention with this part is not to provide a valuation master class, but to explain how to identify these value metrics and why.

Why do we perform valuations on a business?

- To go through a company sale process

- Raise capital

- Financial planning

- IPO

- Bankruptcy

- Acquire a business

- Make investment recommendation (buy/sell/hold)

- Internal business decision making

- Valuing employees´ compensation and options

- Litigation processes.

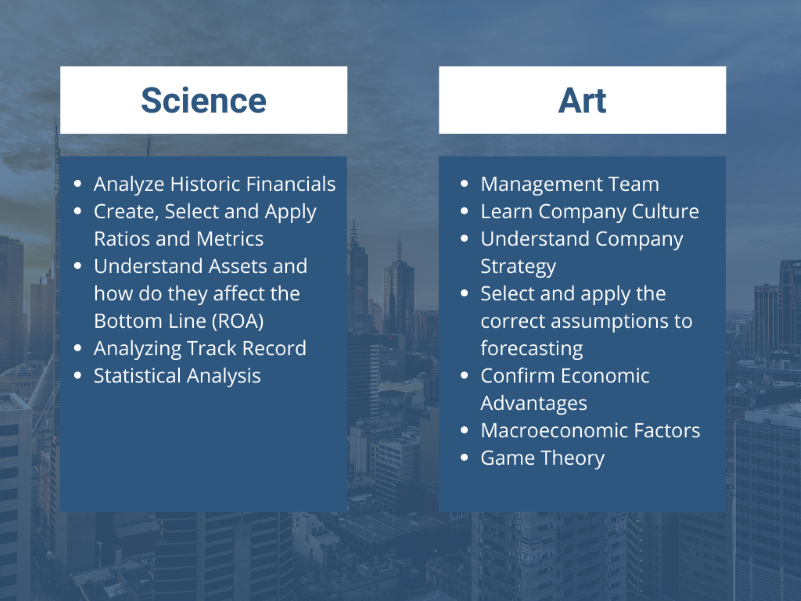

As seen, a valuation is done to address many company situations and at different stages. There are many accepted valuation methods that can be applied. None of them is a straightforward winner when it comes to choosing one. It depends on many things. Hence, it is said that a valuation is both art and a science.

All of the above are just a few things that need to take into consideration when valuing a company. Furthermore, valuing a 21st Century company require of more art than science.

Valuation, in any business is based on expected future performance not past performance and involves:

- Financial analysis

- Market and operation architecture projections to establish financial conclusions

- Industry and economic analysis

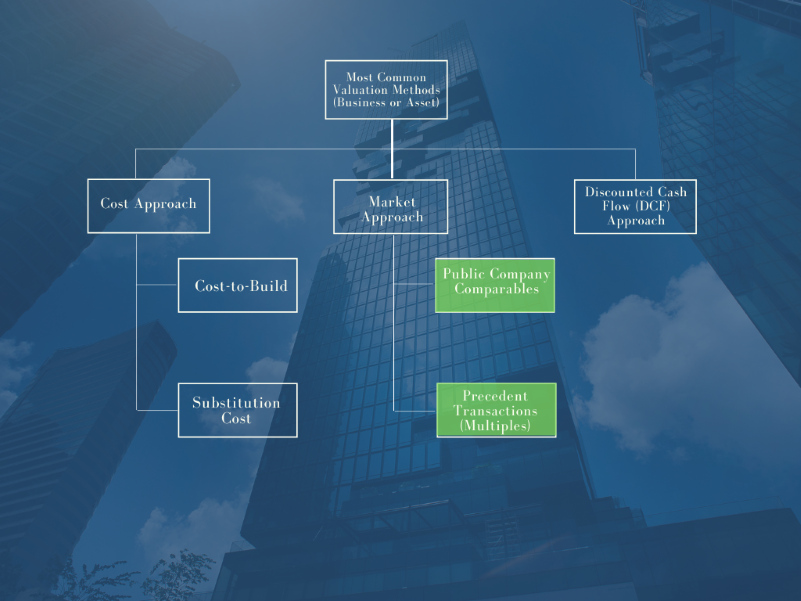

- Applying generally accepted valuation methods

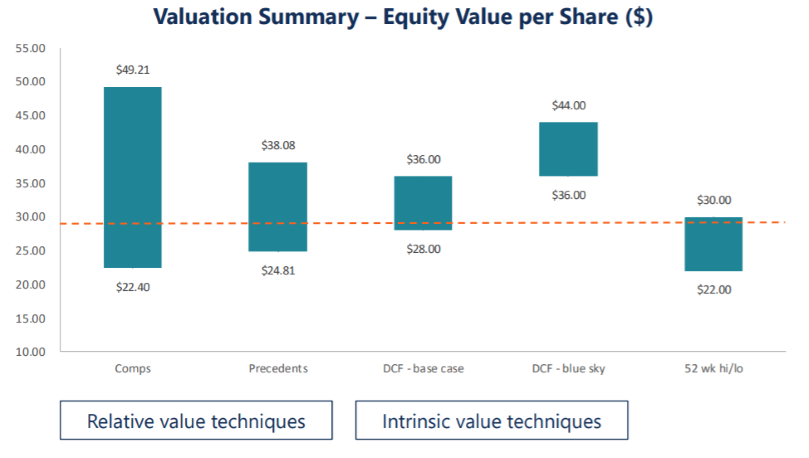

A UNIVERSAL RULE- The market dictates the value of a company. A valuation is a way to back arguments. So, it is in the eye of the beholding valuator that the true valuation approach is selected. Usually, various valuations methods are used to assess each argument. It is regularly represented in what is known a Football Field graph.

Valuation applied to 21st Century Business Models

21st Century businesses are called that because most of them started operations this century. The vast majority of them, as expressed in the Introduction part of this series, have not reached maturity yet. In fact, at least the ones that belong to the models explained in this series, many of them are still in growth stages.

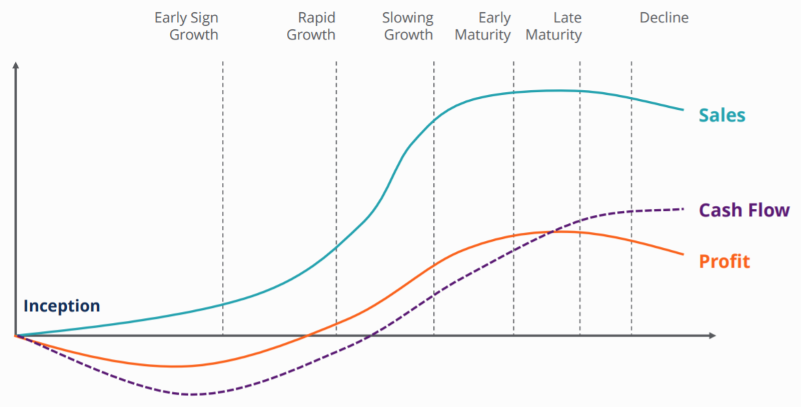

As seen in the graph above, growth company barely generate profits, and sometimes negative cash flows. Does that mean that these companies are failing? NEGATIVE. By now, we should understand that the real value of these companies is in the continuous increase of their customer / userbase, with a credible thesis that this will convert into a cash flow generating machine in the long run. While engaging customers / users, 21st Century companies test various revenue generating ideas until they hit jackpot.

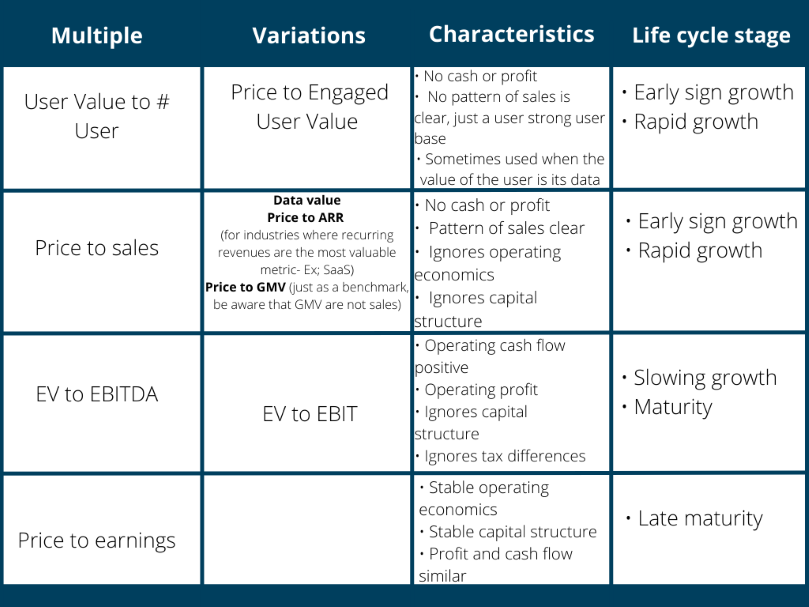

Based on this, the valuation methods that are best applied to 21 Century businesses are market approach methods. There could be times when cost approach methods are applied, especially when valuing a technology or certain intangibles.

By now, I hope, we can all agree that 21st Century Business Models need a new way of being analysed and understood for their true value. It is important for all players in the economic ecosystem around them to have a common communication channel. Investors and corporations, that invest and acquire 21st Century companies, need to understand the value that they present, present and future. After all, they will be analysing their return on investment. On the other hand, entrepreneurs need to communicate their company’s value in a way that the investor or acquiror will perceive the value of their investment.

21st Century Business Models are aligned with the digital age. Hence, although there are many new business models, we have covered the most relevant as of 2021. We have explained how new customer demand and behaviour in a customer driven age drive the success of these models. How they add value to customers and how this value is portrayed in business analysis, converted into kip’s and translated into a financial language, so that investors and entrepreneurs are able to communicate about the value of a certain company.

Our goal has been always to show how to understand 21st Century business models in order to perform valuations that grasp the companies’ real value. In most cases, and due to the drivers expressed, the value lies in the very first lines of the P&L. This is all related to, what is more related to the customer itself, revenues, and COGS. This value is better explained in the assumptions that result in the upper lines: revenues, gross margins, contribution margin and cost of customer acquisition. If we understand how a business addresses customer needs, how it manages or project these upper line economics and how the KPI’s that are communicated, then it will all make sense. If you were a 21st Century Business Model valuations’ sceptic, and now you understand what drives their valuation, our job has been gratified. If you are an entrepreneur and you have learned how to communicate the value of your company, we will both succeed. If you would like to extend the conversation, learn more or are thinking of pursuing a corporate operation that involves the acquisition or fundraising process of a company with a 21st Century business model, I will be more than happy to do so. You can contact me at [email protected].

Aknowledgements

There are countless people who I need to be thankful to. I have been interested in the financing stages of both new and growth projects since the beginning of the 2000’s. Have had many mentors, along the way. One of them, late Cesar “Tito” Montilla, who mentored me in many things regarding corporate finance, who showed me that knowledge was meant to be spread and to find ways to express what I am knowledgeable of. To my wife, who pushes me to find the better version of myself. To Laura Catalán and her team, for encouraging me and laying out my blog posts and ebook. To the ONEtoONE Corporate Finance team and their support. To all of you, Thank You!

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.