Written by Yolanda Plaza, Senior Manager of ONEtoONE Corporate Finance Spain

The economic crisis generated by COVID-19 has forced many companies to take advantage of extraordinary measures, both operational and financial, to ensure their viability.

Despite everything, we continue in an environment of high uncertainty and complexity. Companies continue to see their ability to generate profits and cash seriously diminished, with which they can meet their payment obligations. This situation will take many of them to consider the necessity to approach financial reconstruction processes, which allows them to adapt its capacity of return of debt, to the expectations of its businesses’ evolution.

It is fundamental to have complete, rigorous and updated information to carry out debt restructuring successfully. It is also essential to plan the strategy and count on expert professionals, knowledge of the market and enterprise mentality, that contribute credibility, confidence, and accompanying in this process. In many cases, that is critical to obtain the companies’ survival.

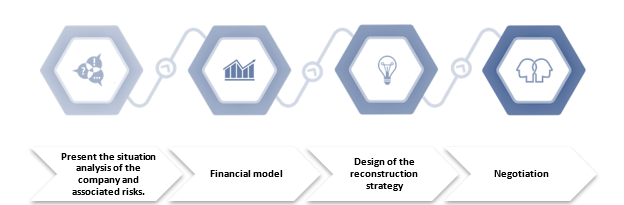

In general terms, the critical phases of a restructuring process are the following:

Source: own creation.

Present the situation analysis of the company and associated risks

First of all, we will have to analyze with a strategic approach to the company’s causes to this situation of distress. We will then detail how it has affected the economic crisis derived from the sanitary problem to our business model and our competitive position in the market. We will also document the operative and financial actions to align the company’s capacity of growth, with the one of debt refund.

This analysis will also help understand business risks and mitigation mechanisms to present them to financial institutions.

It is recommendable to elaborate an executive summary with general information of the company and the sector in which it operates that it includes among others: the shareholder and corporate composition, its geographic presence, the landmarks achieved, a brief explanation of the value proposition that the company offers to the market and its competitions critics, its organizational structure and finally a situation analysis of the present and potential market future scenes.

Preparation of the financial model

It will allow us to have a tool that quantifies risks, profitability, debt refund capacity, and scenarios that analyze the model’s hypotheses’ sensitivity, thus generating a fundamental document for the refinancing request to financial institutions. This model will include:

- Analysis of the historical financial information will help lay the foundations of the projections of the model, understanding the evolution of the profit and loss account and the balance in profitability and liquidity terms. The analysis will make it possible to determine how the free cash flow has evolved in each period, that is to say, the package generated by the company’s activity and assets. This is caused after meeting the needs for reinvestment in fixed assets and operating working capital, without considering financing. The analysis can also determine the debt cash flow, that is to say, the cash destined to the payment of debt principal and interest net of taxes, plus the contributions of new debt.

- Diagnosis of the present financial position: that it will include a detailed description of the composition of the debt by type of product, limit or matters granted, expiration date, current risk or amount ready to present date, breakdown of short-term and long-term debt, and contributed guarantees; all it classified by each one of the financial organizations that compose the pool of the company.

- To develop the projections of the profit and loss account, balance and future analyses of cash-flow considered based on the historical information and to the hypotheses raised by the company, which will include:

- Sales volume: Make an estimate of the future business volume and actions to maintain the sales contribution margin, covering fixed costs and generating profits. These estimations are coherent with the evolution of the sector and the competitive position of the company.

- Fixed costs: Define measures to adjust and minimize fixed costs of both production and structure, adapting them to the estimated capacity and removing as far as possible all those that are superfluous to the productive activity.

- Working Capital Requirements – WCR: Optimize management, planning negotiations with suppliers and commercial creditors to achieve a longer payment term but without generating tensions that could cause breakages in supplies; the request for postponements in the payment of tax obligations if necessary, but always complying with the agreed commitments; propose the means to maintain complete control over the customer portfolio, to ensure timely payment and avoid high defaulting ratios; and finally, plan inventory management to avoid allocating more resources than necessary to maintain the investment in stocks. If we optimize WCR management as much as possible, the company’s cash flow tensions will be lower and, therefore, the company will also reduce its external financing needs.

- Capital Expenditure – CAPEX: Analyze the investment needs to maintain the estimated productive capacity and determine if there are non-strategic fixed assets that the company can divest and generate additional cash flow.

According to the base case projections and the analysis of alternative scenarios, we can determine the expected operating free cash flows, which will guide the new financing structure.

Design of the restructuring strategy

It is part of the financial model, based on establishing a viable financing structure, that allows:

- To redefine the current debt structure, in terms of due date, cost and guarantees, to adapt it to the generation of estimated free cash flows and the previously analyzed risk/profitability profile.

- To evaluate the possibility of substituting part of the bank debt for non-bank debt.

- To analyze the necessities of Equity: with entered potentials of new financial or industrial partners; or extensions of the shareholders’ capital, who allow fortifying the patrimonial situation of the company.

Negotiation and closing

Success in the negotiation and closing of the process depends mostly on developing a solid financial model. This model has to provide credibility to financial institutions and professionals experts in the area, who know the market and establish a competitive process between credit institutions and other investors, which allow achieving the established objective in the most advantageous conditions for the company.

The strategic importance is not due to ignoring that it has a relation with the different financial organizations. It is not just a matter of locating the cheapest source of financing, but of creating a lasting relationship with the other financiers. Thus, the best conditions are available in a sustained way over time.

About ONEtoONE

At ONEtoONE, we have extensive experience as financial advisors and credibility as a structuring / appraiser / modeller in refinancing operations with financial institutions and equity investors. For more information, click the button below to contact us.