The due diligence process is a basic procedure, carried out when a company evaluates the advisability of carrying out a merger or acquisition, or when an entrepreneur is considering selling their business (in this case it would be called vendor due diligence). This process encompasses different areas of analysis: the financial, tax, legal and labour areas are necessary in the evaluation of any transaction that must be analysed by independent advisors on behalf of one of the parties involved. Other areas such as the environmental area, for example, will only be necessary depending on the sector in which the company under investgation operates.

Why is due diligence important in a sale and purchase transaction?

In the context of a sale and purchase, the main purpose of due diligence is to ensure that the acquisition (in the case of the investor) or the financing of the acquisition (in the case of the financier) will not entail unnecessary risks for those interested in the acquisition (investors or financiers). The due diligence process gains an in-depth understanding of the business to be acquired, from its cash flow and profit generation to the risks involved.

Financial due diligence is based on analytical review procedures applied on written or verbal information provided by the management of the target company to the due diligence team and/or obtained through public information sources to verify the facts and information provided by the seller, and to assure the commissioning party that the transaction does not involve risks that it is not willing to assume. A large amount of information and documentation is requested and must be analysed by the different teams carrying out the analysis in each area.

From the seller’s perspective, due diligence requires a great deal of preparation and is an opportunity to ensure that the documentation provided to the buyer accurately reflects its business, to correct any irregularities and to properly manage any deviations in the agreements to be negotiated between the parties.

Below, we tell you what the key points are and present the strategies with which to approach this process.

1. The importance and necessity of due diligence in the company sale and purchase process

Due diligence is essential for the closing of the transaction, both from the point of view of the buyer and the seller. It is an important step in the process of selling a company, whereby the buyer, through its advisors, examines the company in depth to decide whether to make the purchase and how to handle any issues that may arise during the due diligence process in the purchase contract.

Either party can commission due diligence, but when the seller itself comissions it, it is called vendor due diligence.

Sellers themselves may be interested in speeding up the sales process and by carrying out due diligence, they save time and effort for potential buyers.

You may be interested in: Process of selling a business.

2. Organising all relevant information

For the seller, due diligence can be a taxing process. As a result, we advise business owners to compile and organise all relevant information about their company. This includes financial statements, contracts, employee data and legal documents.

For the benefit of potential buyers, this information should be presented in a clear and succinct manner.

The creation of a virtual data room or virtual platform is very useful. It is a secure space for the distribution and archiving of documents. It can help ensure that information is accurate, up-to-date and organised in a way that is easy to navigate. Such platforms also allow traceability of access to information by the different people involved in the process.

This also allows the business owner to maintain confidentiality throughout the process. The seller can increase the likelihood of a successful sale by providing information in this way, thereby fostering a good relationship with the buyer.

Buyers are more likely to choose the business of a motivated and well-prepared seller. This is because it instils greater confidence in their decision-making process.

3. Seeking professional advice

Using third-party service providers costs money, but it can offer a variety of benefits. We would advise you to engage with M&A specialists, such as financial and legal experts, in order to improve the effectiveness of the due diligence process.

Normally, the aspects that the buyer will evaluate are:

- The financial situation of your company.

- Cash flow.

- Income trends.

- Assets and liabilities, including the evolution of working capital and the determination of financial debt.

- Adequate compliance with tax obligations and, where applicable, the assessment of possible contingencies.

- Commercial, labour and other applicable legal aspects.

To further assess the financial health of your business and establish its value, you can also review financial projections by understanding the assumptions used in their preparation and their reasonableness with the company’s historical performance.

These experts will guide you on what information to provide to prospective buyers and how to present it.

You may be interested in: Finding the right M&A advisor.

4. Relationship management

The due diligence process requires excellent relationship management of two distinct areas: the buyer, and advisor networks.

When it comes to selling your company, we encourage business owners to put themselves in the buyer’s shoes and anticipate the types of queries they might have. These may include:

- Concerns about the company’s financial performance

- Market trends

- Shareholder rivalry

- Customer relationships

- Other factors that may affect due diligence

Likewise, as mentioned above, seeking professional advice is necessary if you wish to sell your business. We encourage the seller to build a rapport with the advisors and rely on their expertise to guide them through the process.

Misinformation is a common occurrence during the due diligence process. Thus, sellers should be as open and transparent about the strengths and weaknesses of their business, disclosing any potential risks or liabilities, in order to build confidence among potential buyers.

During this due diligence process, you may feel uncomfortable with the meticulous questions involved. But remember that it is essential to communicate frequently and transparently with the buyer, addressing their concerns.

Being patient and transparent will reinforce your image and that of the company to the buyer. This will be reflected in the price you get and will facilitate the deal in the subsequent negotiation, ensuring a successful sale.

5. Controlling the process

Moving with a sense of urgency is crucial for all stages of due diligence however this is distinct from rushing.

Sellers should control the due diligence process. Clear deadlines and goals can achieve this. In this way, they can identify aspects of their business which need further attention or clarification. This will further allow them to leverage their advisors, networks and their own skill set to gather the information required.

It’s important to keep in mind that the deal requires the consent of both parties every step of the way. A buyer could terminate the process if they feel time is slipping.

However, the seller should never rush the process. They should stick to an urgent pace, thus maintaining their momentum and using the time they have to engage with the buyer closely.

Longer due diligence periods are more likely to lead to completed deals, more specifically, ´medium-length´ due diligence processes are those most likely to complete. We call this a ´happy medium´ or the ‘Goldilocks Effect‘.

Learn more in: How long does it take to sell a business?

6. Finding the happy medium

When a due diligence period is neither too short nor too long, there is a greater likelihood of the deal reaching successful completion. This is due to more time spent on planning. In order to run due diligence effectively and efficiently, many dealmakers are now devoting significant additional resources to this work.

Virtual Data Rooms also help dealmakers work through due diligence more quickly, even when many additional issues need to be resolved. Despite this, buyers still have to contend with delays on the sellers´ side.

7. Positive outcomes of the ´Goldilocks Effect´

The length of the due diligence process is related to the likelihood of a deal successfully closing. Deals with a medium-length due diligence process are not only more likely to reach completion but also have additional benefits.

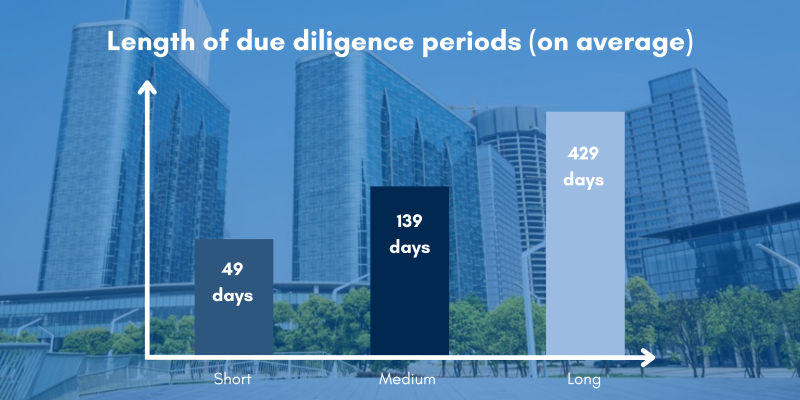

How long does the average due diligence process take? Generally, we can divide the processes into periods as follows:

- Short-term due diligence: 49 days.

- Medium-term due diligence: 139 days.

- Long-term due diligence: 429 days.

In the following, we explore the advantages of carrying out a medium-term due diligence.

Benefits of a medium due diligence process: Shorter deal resolution time

Medium-length due diligence processes are associated with shorter resolution times. Where due diligence was medium-length, the average period between the public announcement of a deal and its completion was 104 days. This fugure rose to 135 and 141 days in long and short processes, respectively.

Medium-length due diligence processes appear to achieve the balance that ensures a smooth running deal, buyers secure the data and insight they require while avoiding unnecessary complexity and delay.

The evolution of VDRs and technology also plays a role in the avoidance of unnecessary delays. It gives dealmakers new tools to conduct more robust due diligence exercises – helping to manage the due diligence process more efficiently.

8. Why optimise the due diligence process?

The most important reason to focus on optimising the due diligence process – particularly for buyers – is that deals with optimised due diligence deliver outsized returns for shareholders.

Based on a period that starts 3 months prior to the deal announcement and ends 12 months after completion, deals with medium-length due diligence processes generated returns of 4% for investors on average. In contrast, deals with long due diligence processes delivered an average return of negative 3% and deals with short due diligence processes produce dan average of 2% return.

Deals with medium-length due diligence periods also outperformed over 24-month and 36-month time frames. It delivered higher returns for shareholders in both cases.

Conclusion

To conclude, investing more time in due diligence for an average duration of 100 days can help to build greater confidence in your buyer and a quicker closing of the transaction.

While it could be a tricky process for many sellers, investing in an M&A specialist to carry out due diligence offers a variety of benefits. As previously mentioned, organising all necessary information, managing relationships with the buyer and advisory team, controlling the process and finding the ´happy medium´ time length contribute to making the process seamless and successful.

Following these steps will strengthen the image of the company, raising its value, which is ultimately reflected in the price you will recieve in its sale. Due diligence is a key step in the selling process. It sets a key foundation for the next phases, facilitating negotiotiation and ensuring a successful sale, highlighting the importance of carrying it out with preparation and patience.

Article written in collaboration with Ana María Martos

Ana María Martos, Partner of ONEtoONE based in Barcelona, specialises in the due diligence process. She has published “La Due Diligence Financiera” to share her expertise on the importance of the due diligence process in the financial setting.

Ana Maria boasts degrees in Business Administration at Universitat Autònoma de Barcelona, Spain, Woman and Leadership Program at IESE Business School, Madrid and Internatonal Commerce, Universitat de Barcelona, Spain. Her sector expertise include pharmaceuticals, industrials and media.